YOU HAVE JUST DISCOVERED THE TRADING STRATEGY BUILT TO PROFIT REGARDLESS OF MARKET CONDITIONS! BULL OR BEAR.

Trading in the stock market can be difficult at times. Other times, you can find yourself losing your investment with one bad trade. For season traders, it's not just enough to know how to read a stock's technicals. Or even that matter the fundamentals. You have to be able to execute your trade at the right time and at the right moment. This can be overwhelming for many.

With the Momentum Market Timer, we have built a quantitative model that uses applied mathematics, technical indicators, machine-learning with pattern recognition to help make you money regardless of the market is in an uptrend or downtrend. To learn more about our Momentum Market Timer, please go here.

When you subscribe to our Momentum Market Timer, you gain access to our world-class Portal Stock App, MogulUp. MoglUp is your one-stop access to all of BullGap's products and services.

EASY TO FOLLOW ONLINE TRADING TOOLS FOR FINDING CLEAR ENTRY AND EXIT SIGNALS.

Do you find it difficult to know when to buy a security asset like stocks, ETF, etc? How about when to sell at the right time before the market turns on you? With BullGap's online trading tool, we make it easy for beginners and professional traders to trade a stock or ETF with clear and concise trade signals.

With Trend Finder, you will receive buy and sell signals that tell you when to trade and what stock or ETF to trade. Using our quantitative model, technical analysis, and deep learning, we run thousands of simulations of trades for the underlying stock\ETF at hand. From those simulations, we build a matrix cluster of potential outcomes that determine the trend for that particular market. What you get from these strong signals identifying upward or downward trends. To learn more about our Trend Finder, please go here.

When you subscribe to our Trend Finder, you gain access to our world-class Portal Stock App, MogulUp. MoglUp is your one-stop access to all of BullGap's products and services.

Using Artificial Intelligence with Deep Learning, RallyPoint provides a powerful yet easy-to-use tool for identifying market trends and patterns for the stock market.

RallyPoint

RallyPoint is a machine learning and deep learning platform that gathers enormous amounts of market and financial data, organize\aggregates those data and uses algorithms to train and test the data to determine the outcome result.

Whether you consider yourself an experience or novice investor, BullGap provides you with Market Pulse - a one-stop vantage point on what is happening within the market place.

Reading the current stock market action can be overwhelming and confusing. With BullGap's Market Pulse, the market is presented to you by way of facts with supporting data using technical analysis, historical data, and our analytical models. The major indices such as the S&P500, Nasdaq, Dow Jones, and small caps are analyzed and highlighted for you to review.

In-depth fundamental analysis of any tradeable company in the stock market. Save time and start investing now with BluePrint Six.

It takes a lot of commitment, time, and energy to follow any one company to understand the fundamental financial level for that business. Sales, earnings, growth potential, assets, debt, management, products, and competition. For any investors who would like to do a deep dive into a company's holdings and future potential, one would need the right tools to analyze and create estimated value for the asset.

With BluePrint Six, BullGap has compiled for each company the raw data necessary to create financial models to determine the intrinsic value for that company.

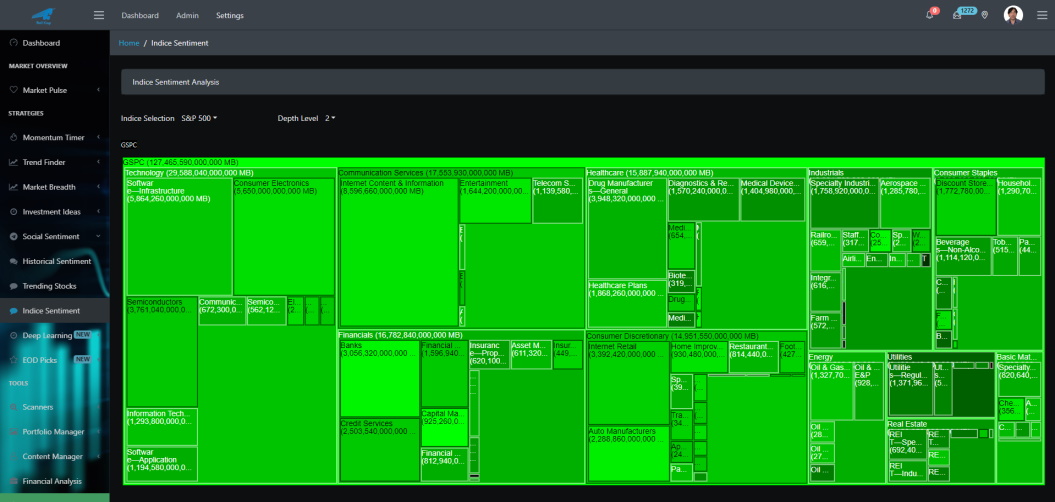

Introducing a new feature that gives sentiment insight into the major U.S. financial indexes.

This new sentiment heatmap for U.S. indexes has been added to Market Pulse to allow users to see trending stocks from a social sentiment standpoint.

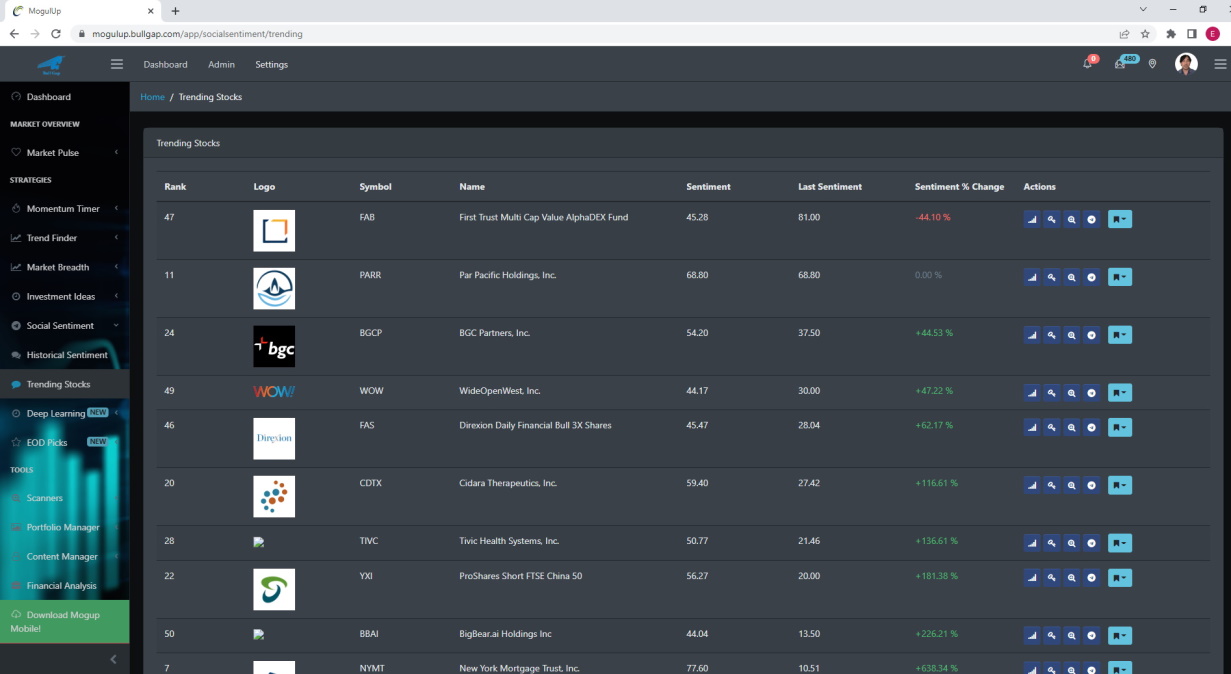

New social sentiment tracker has been added to Market Pulse to allow users to see trending stocks from a social sentiment standpoint.

On Friday, Wall Street achieved its second-best weekly gain of 2025, with the S&P 500 (SP500) surging by almost 5%. On Friday, Wall Street achieved its second-best weekly gain of 2025, with the S&P 5...

This week, the S&P 500 experienced a death cross, a technical pattern characterized by the 50-day moving average falling below the 200-day moving average. The index is now in a downtrend and can be d...