Tale of Two Tapes

What a ride it has been this year for investors. If you are still here with us then you certainly have seen two extremes in the market this year. By all measures, COVID-19 spread as a regional crisis in China's Hubei province to a global pandemic that has disrupted global economies and rocked the stock market.

Global Economic Disruption

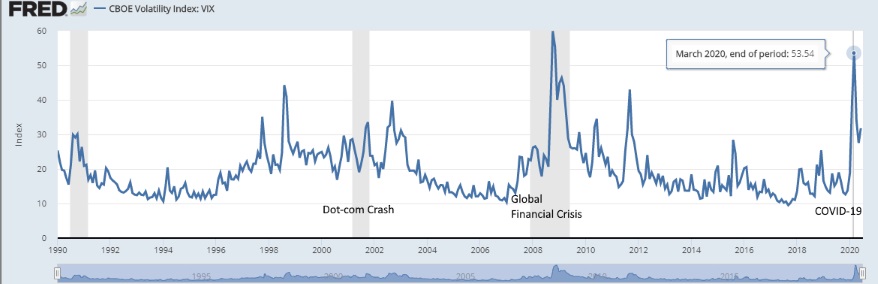

When governments world-wide issue strict economic shutdown, it caused major upheaval and volatility in the global market. The image below shows what impact COVID-19 has had compared to other recent crashes.

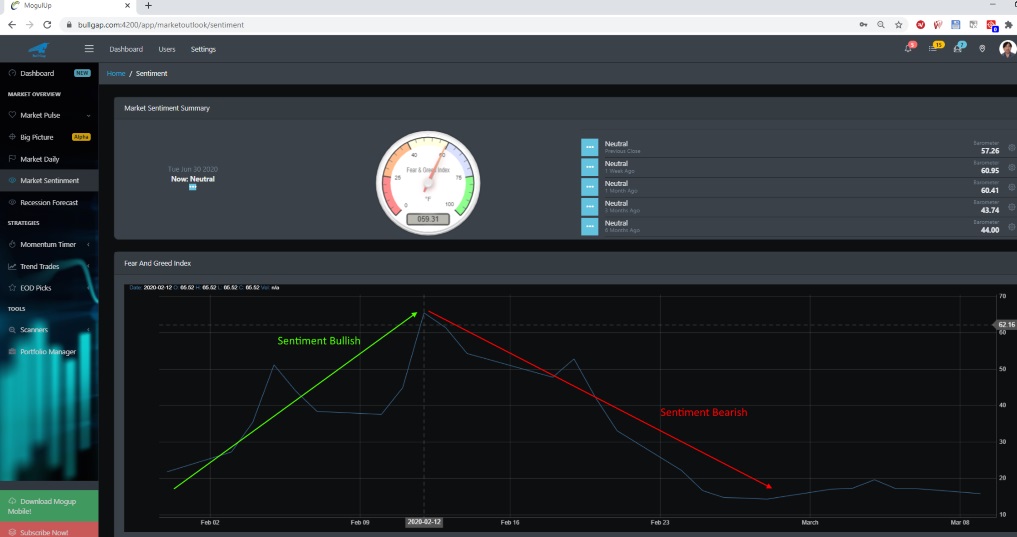

Additionally, BullGap's Fear And Greed index during that time showed bullish sentiment hitting all-time highs and then dropped once COVID-19 news infected the marketplace.

V-shape recovery in Q2 2020

The S&P 500 dropped 20.62% in the first quarter of 2020 and by the end of today's trading session, it was up 19.95%. Earlier this month, the Nasdaq-100 hit its intraday record high on June 4, 2020. To be clear, much of the economic data is slowly showing an uptrend. However, as discussed in some of our prior blogs, there is a disconnect between main street and wall street.