With an endless number of bad news floating around in the markets, market participants have quite a bit to think about as it relates to the market and their portfolio. The wall of worry has many names now. Fed raising rates and QE tightening, inflation running "HOT", recession scare, tech sector f...

Blog

It was only recently back in February that we suggested in our prior blogs to buy the dip. There was a fair amount of bearish news coming out of the financial markets but a fair amount of data that we were looking at that suggested the bottom was struck. That week coincided with the start of the R...

Q1 2022 closed out this week making it the worst quarter for the US markets since the pandemic hit back in Q1 2020. However, for the past 3 weeks, markets have been pushing higher from their lows set back in late February of this year. The S&P was down -13% for the year and did an about-face to ra...

Markets had the strongest gain of the week for the entire year. In fact, the S&P pushed higher to its best weekly performance of the last 12 months. The S&P posted a +6% gain, Nasdaq was the winner with +8.5% and the Russell 2000 moved higher +5.3%. In our last blog on February 27, 2022, we said ...

It is interesting how one month can change an investor's perspective in the markets. With one of the strongest rallies in over a decade, the rally off the March 2020 lows had everyone coming into 2022 with a bullish attitude. Our market sentiment index had a reading of +65 coming into the new year...

Super Bowl weekend is here but that excitement did not translate too much for the equity indexes this week. Only the Russell 2000 posted a positive gain for this week. Though it has been down -10% YTD, IWM was able to make a solid +1.3% gain to close out the week. The S&P 500 and Nasdaq felt the ...

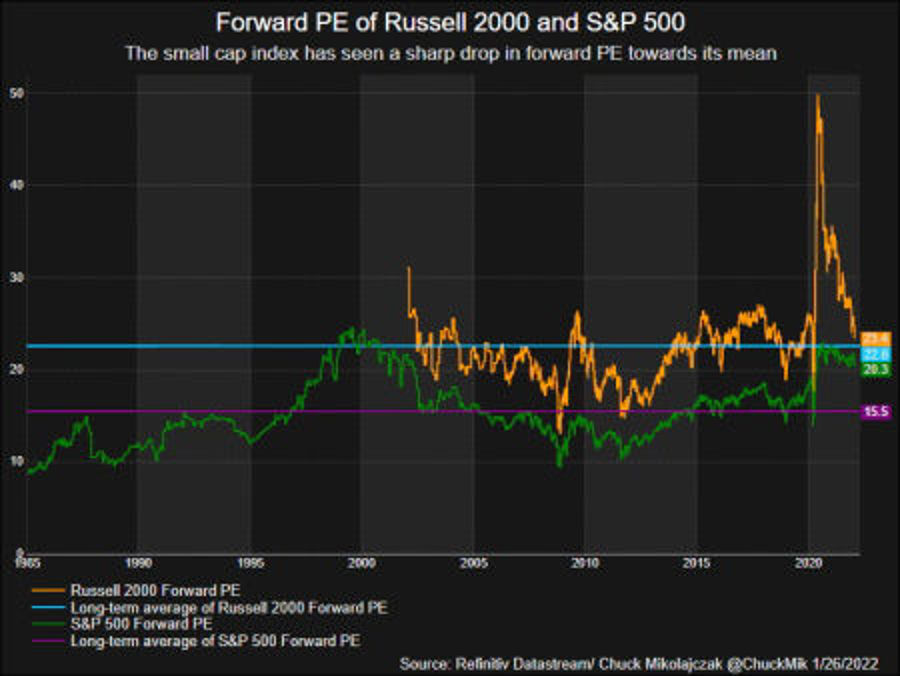

The January slump for the equity markets has been downright painful to watch. All major indices posted losses for the month of January. Russell 2000 is down more than -9%, Nasdaq is at a negative -8.9%, and S&P 500 is more -5% to start the year. Across the key sectors, only energy has been pushin...

Equity indexes found a little footing this week with a majority ending the week in green. After dropping more than -5% last week, the S&P 500 wrapped up the week +1.7%. Nasdaq which fell over -6% last week, went over 2% this week. The Dow Jones also dipped more than -4.5% last week, it too wrappe...

Starting in the summer of 2020, the Quantitative easing kicked into high gear with the Fed buying over 120 billion in debt securities. With the massive government stimulus package and high liquidity flooding the market, inflation reared its ugly head. Originally, the Fed attributed the rise in inf...

Markets opened the first day of the 2022 trading year by hitting all-time highs. DJIA pushed higher on consecutive days to start the first week of the 2022 trading week. It was not all gravy as markets started to consolidate and close out the week in the red. With the Fed strongly suggesting that...

- 2025

- 2024

- 2023

- 2022

- 2021

- 2020

- 2019