Equity indexes found a little footing this week with a majority ending the week in green. After dropping more than -5% last week, the S&P 500 wrapped up the week +1.7%. Nasdaq which fell over -6% last week, went over 2% this week. The Dow Jones also dipped more than -4.5% last week, it too wrapped up +1.9%. The only Russell 2000 was the only index to close out in the red at -0.9%.

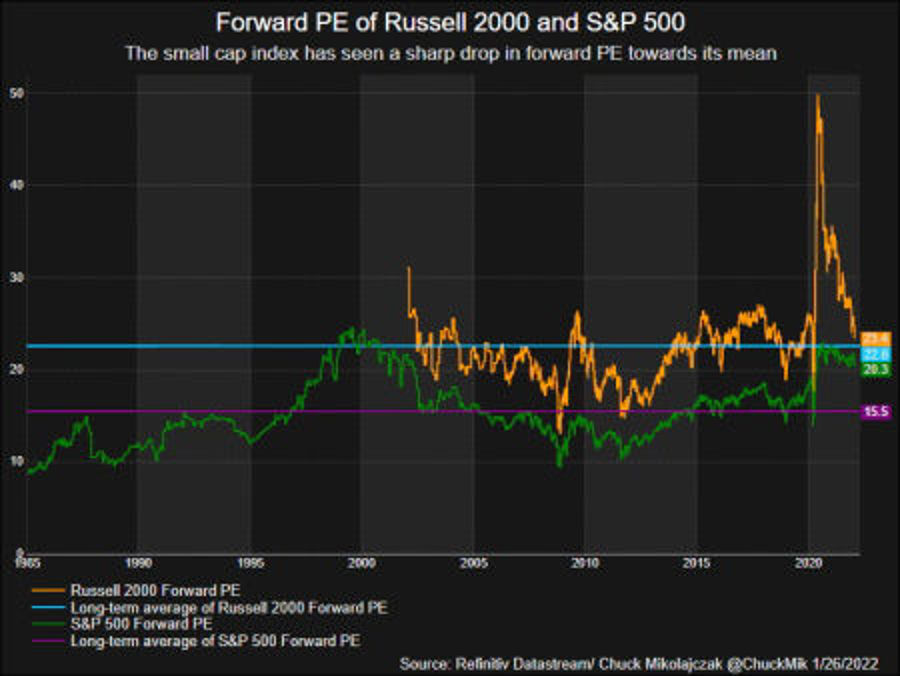

It is safe to say that the U.S. financial market is having a rough start to the year. The S&P 500 is down more than -7.5% and SPY ETF is near the 10% correction area. With the rising interest rates, the tech sector was hit hard (QQQ) as well as small caps (IWM).

Overall, it may still be too early to tell if a bottom is in but let's look at some of the data for this week.

Big Picture

Indices, sectors, ETFs, cryptocurrency have all dipped for most of January. It is clear markets are in a correction with AAII bearish sentiment reaching an all-time high. But with recent strong earning reports such as coming from Apple, the dip buyers came out to help close out the week in the green. It is the first up week since 3 weeks ago. 2 weeks ago, we noted that there was still downward pressure on the market and that downward pressure showed up on Monday where the S&P 500 hit a low of 4222.62. Support was held on Monday and the S&P 500 closed out the week around 4432.

Market Breadth

Looking at market breadth data for the past 6 months, it is evident that the near and long-term breadth has been in decline. Several key bearish cross-over triggered in late 2021 and that has spilled over into January.

Market Sentiment

For the past month, BullGap's market sentiment has been in the fear territory. After reaching a high of 66.06 on January 3, 2022, it has now dropped to the 20 levels. 21.37 is the lowest the index has seen since November 2020. November had a similar structure wherein October 2020, markets hit a high and then dipped. Because it is rare for market sentiment to remain at this level for a long period of time, there is a high probability that markets have a near-term bounce coming out this week.

Economic Outlook

With rising prices here to stay, the Feds are shifting to more of a hawkish stance. With the Fed switching away from their 2021 stance that inflation is transitory, the current discussion on rate hikes has hit the tech sector and crypto hard. With inflation being one of the walls of worry for investors, let's take a look at some of the data. With the "Trimmed Mean PCE inflation" chart below, it is clear that prices are still moving higher. However, if we look at some other inflation metrics such as the 16% trimmed-mean CPI, it shows a decline since December 21. This chart represents the median price change of goods and services.

Market Outlook

This week we will take a look at the market from the 60-minute chart. The roller coaster ride continues this week with intraday highs hitting resistance and support keeping markets from tumbling from the low of Monday's selling. If anything, there is a silver lining that can be seen in the intraday chart. Looking at the three major indexes, there may be a bottoming forming in the markets.

SPY

On Monday, markets hit a low but have since held support. The yellow outline below has a look of a possible cup and handle with SPY right now at the 200-day EMA.

QQQ

QQQ also dropped to support on Monday but held and has since formed what looks to be a double bottom.

DIA

Like SPY, DIA is right at its 200-day EMA and it also has a similar pattern of a cup and handle.

Concluding

Technically speaking the daily MACD is slowly turning positive. Additionally, the RSI levels for the major indices are all in extreme oversold territory. It is still too early to tell if a bottom is here but the intraday readings are suggesting that a bottom has been struck. With the overall trend still being a bull market, we see this as a buying opportunity with a high probability that markets are gearing for a push higher in the next coming weeks.