Over the next couple of weeks, more than 65% of companies are set to issue out their Q3 earnings. A majority of those companies fall in the S&P 500. Last week, financials reported some fairly good gains. This week, the market turns its attention to how well corporate America has coped with the continued economic turmoil as a result of COVID-19. Many tech companies are line up for this week. Netflix on Tuesday and Tesla is scheduled for Wednesday. For the market, last week was lightly positive for most major indexes (except for the Russell 2000 which drop -.23%). The S&P 500 is within 3% of all-time highs.

Big Picture

2 weeks ago, we discussed how the markets had a breakout and were holding onto the hopes that a stimulus deal would get done. BullGap's market internals for that week was at an all-time high uptrend. As we discussed in that blog, we were concern that the current rally was being influenced by the hopes of a stimulus package. This week, the stimulus package is still at a stalemate with House Democrats and Treasury Secretary Mnuchin still at a standstill as to how to deal with State bailouts.

Below is a screenshot of the Big picture view. There is a yellow line that indicates the average support line (Deep learning computed) for the S&P 500. The market is currently right at that level. Both the 20-DMA and 50-DMA also are acting as support at around that range. Below that level is the blue support line which is recent lows from September. Any break of current support would send the market down 8%. Right now, the market seems to be in a wait and see a pattern. If we look at the monthly long term view, the market is overstretched and overbought. However, the bull market is still currently intact.

State of the Economy

As discussed numerous times in our past blogs, the Fed's fiscal policy of flooding the market with liquidity has really fueled the rising inequality and financial instability. It is not only the US Central bank that is doing this but the global banks as well. By boosting spending, slashing interest rates, and flooding the market with credit, the government and central banks have helped prolong business cycles. As noted in this article by Jim Reid and Craig Nicol, extending business cycles will eventually lead to a more severe recession.

Trying To Prevent Recessions Leads To Even Worse Recessions

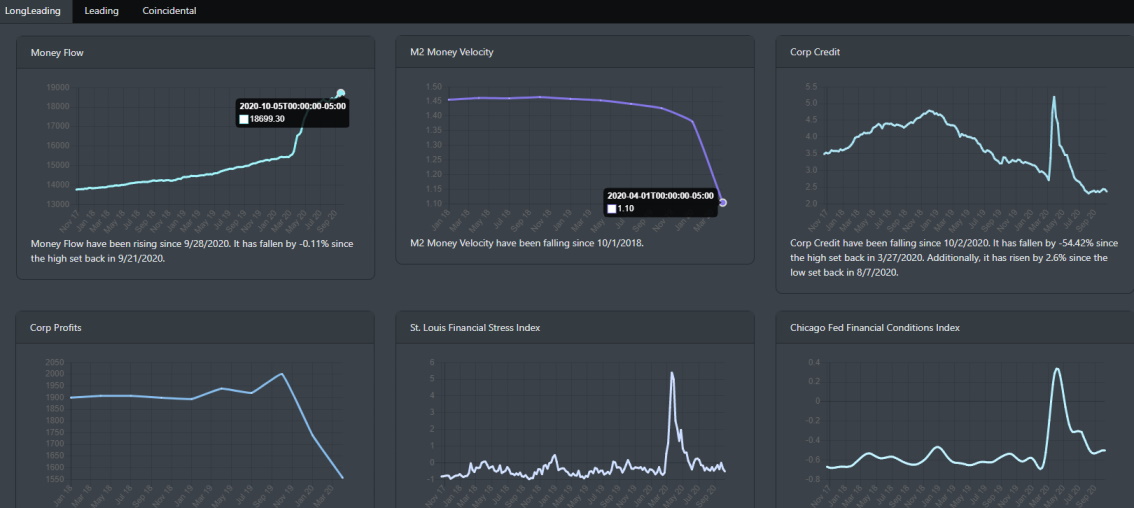

If we take a look at the snapshot of "Money Flow" below, we can see how the Fed's balance sheet expansion has injected ample credit into the Market. But interesting enough, if we look at the "M2 Money Velocity", we see that it tells a different story. Monetary velocity is a way to measure the health of an economy. The frequency in which a dollar is spent to buy goods and services over time. The Money velocity is currently reading all-time lows and this is typically indicative of a recession or contraction in an economy.

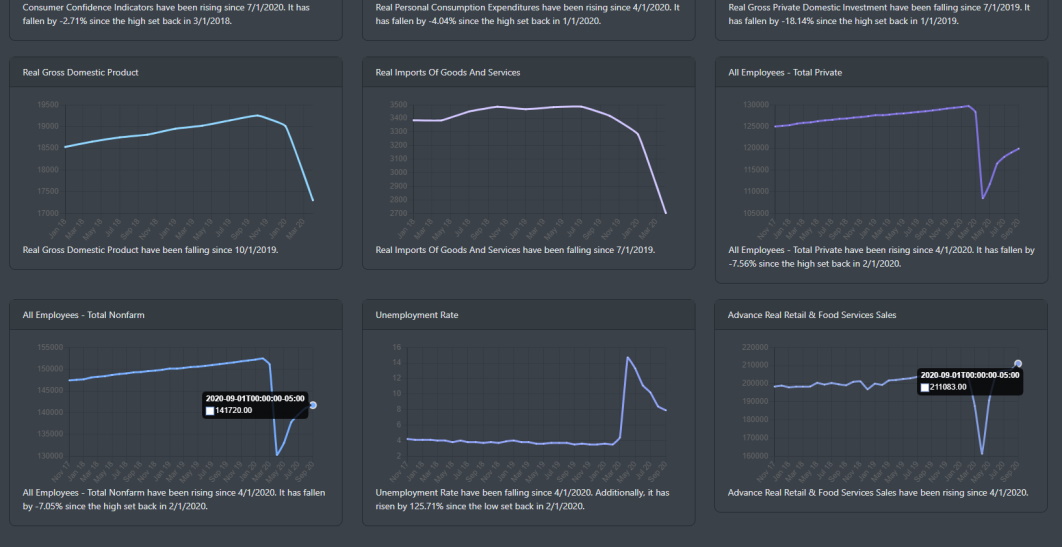

Looking at the below snapshot, the job recovery seems to have a peak and is currently in a neutral position. Hiring is slowing down, temporary furloughs convert into permanent job losses and the new claims for unemployment still remain high. If you look at the number of nonfarm payroll jobs in the lower-left chart, you will see that it fell by more than 15% in just six weeks during the pandemic outbreak. That number comes out to around 22 million jobs lost within that timeframe. One good news is the "Advance Real Retail & Food services sales" chart which is reporting solid numbers. Total retail sales continue to rise.

Market Outlook

Markets were fairly positive last week. On Monday, the markets look like they were about to start the week by testing old all-time highs. By Thursday, both SPY and QQQ broke the trend and are below recent highs. QQQ is just right below its recent high of 303.06.

SPY broke the trend late last week and is just below its last high of 357.

Conclusion

We have borrowed trillions of dollars to support the economy and to prolong the business cycle from running into a deep recession. Additional fiscal stimulus support is currently at a stalemate which means more than $50 billion per month of personal income loss. This will impact consumer spending for Q4. If the second wave of layoffs hit the service industry, a contested election and\or the second wave of coronavirus rears its ugly head, we could see the market dropped to the levels we discussed earlier in this blog.