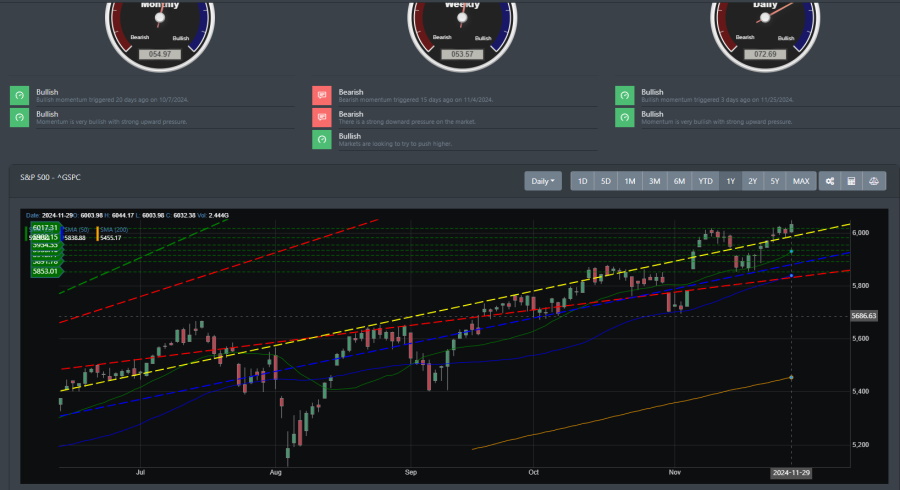

Markets finished this week at all-time highs, with the S&P 500 closing Thanksgiving week over the 6000 marker. After hitting the 6000 marker earlier in November, markets had a recent pullback that allowed the near-term overbought conditions to subside. The technical backdrop is clear. Markets remain in a bullish posture, with the monthly and weekly timeframes all reading bullish.

December historically is a strong month for bulls (especially in an election year), so the path to new highs this month may be complex. With the rebalancing of significant portfolios and share repurchasing, there may be pullbacks to follow into this year's end. However, the bearish thesis is mute, as investors are all on the bull train.

Big Picture

Markets wrapped up November closing at all-time highs. For the years 2023 and 2024, markets were in a bullish uptrend. Typically, bullish markets for the year will end on a high note. In the image below, the S&P 500 is above its average trend line, suggesting there is more upside to come soon. With markets closing over the 6000 marker, the next upward progression would be on the Fibonacci levels, where we see resistance near the 6120 region. From there, markets can challenge the 6250 region. Major support is at the 5853 region with 5700 being October's support.

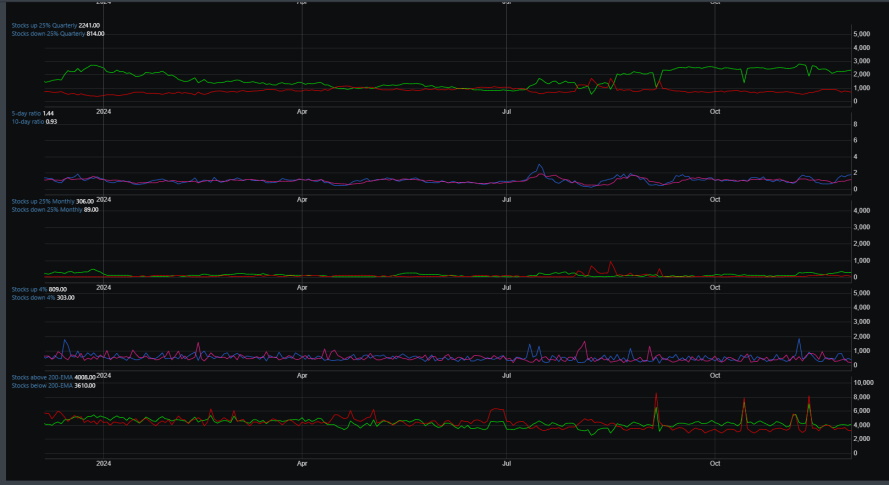

Market Breadth

Market breadth has improved in the past few months. During the bull rally of 2023, investors and market pundits were concerned with the lack of market participants supporting the market. This was mostly due to the expectation of easing of rate cuts that led to the Tech rally of 2023 and 2024. However, small-caps participation in the markets has dramatically improved over the past few months. We can see this when our reading of Stocks up or down 25% in the quarter turned bullish during August. It has remained bullish since then. This is not only a positive note. The long-term market breadth reading and auxiliary breadth readings, such as the stocks above their 200 EMA, are all positive.

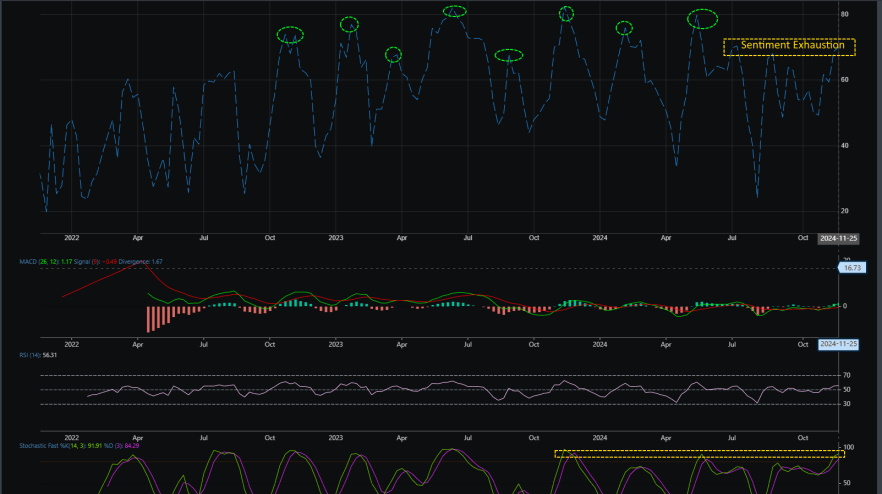

Market Sentiment

Extreme exuberance and speculation are the name of the game in today's market. Everyone is highly bullish on the market. According to Fred's HouseHolds stats, household equity involvement is at all-time highs. Even the NAAIM Exposure Index, which tracks professional money managers' exposure to the market, is at a staggering 98.93 reading.

The image below is a weekly timeframe of our Market Sentiment Index. The green circle is the high exuberance triggered for the past 2 years. Nowhere in our market index reading has there been a 2-year or 1-year period where the number of occurrences of peak readings has been this many. What this reads is that everyone is bullish.

Market Outlook

The historically high bullishness and investor exposure have certainly contributed to the higher markets. The rally from the recent pullback that saw markets hit support near the 5850 region was quite choppy. The potential for a move higher from here is still high. The Nasdaq QQQ is currently looking like it is tapering as market allocation takes way.

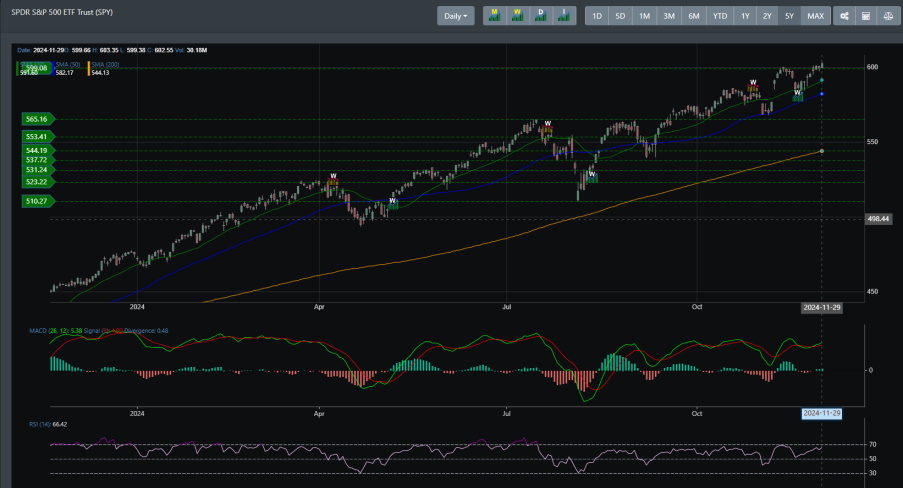

SPY

SPY is in a significant uptrend. It is within the confines of its monthly buy trend, and recently, its weekly buy signal was triggered on 11/18. It has since rallied up to above 600 to close the week.

QQQ

The Nasdaq tech market was the darling of 2023 and 2024. However, with the Feds having stated that no more rate hikes would come this year, investors have shifted their focus to other markets, such as small caps. QQQ is in an uptrend, and it is still probable that it will hit new highs to close out the year.

IWM

Growth over value is where investors are moving to. Smallcaps has been meandering for most of 2023 and had a breakout in late November 2023. It then followed this up with another breakout in July. The most recent breakout came in early November, surging through resistance at the 226 region. With a recent weekly buy signal that triggered on 11/18, IWM is poised to move higher.

Concluding

The technical layout for the markets is bullish. With everyone onboard the bull train, this highly speculative market is ripe with complacency. But at the moment, markets look like they're moving higher into the new year. There is a high probability that we see some dips in early December, but the expectation is for the pullback to be shallow, with investors diving in to buy the dip. Initial resistance for the market is around the 6050 to 6070 region.