Wow, a lot can change in one week. The S&P 500 had one of its best election week performance since 1932. As discussed from last week, BullGap's quantitative and deep learning models were issuing a bullish outlook for the upcoming week. We even mentioned that it would start as early as Monday. And right on cue, this week's rally was quite a reversal from a few weeks back.

While the U.S election has a winner in the U.S president seat, the market is currently looking at the Senate where the Dems could still have a chance of capturing control. In other words, for the market, it does not matter much who sits in the white house. If the GOP can maintain control of the Senate and narrow the majority in the House, gridlock is almost certain in Congress. This means that it is highly doubtful that there will be any sweeping changes to affect the market. Significant policy changes such as large spending on green energy, a major reform to the health care system, higher corporate taxes, will probably not happen immediately.

Big Picture

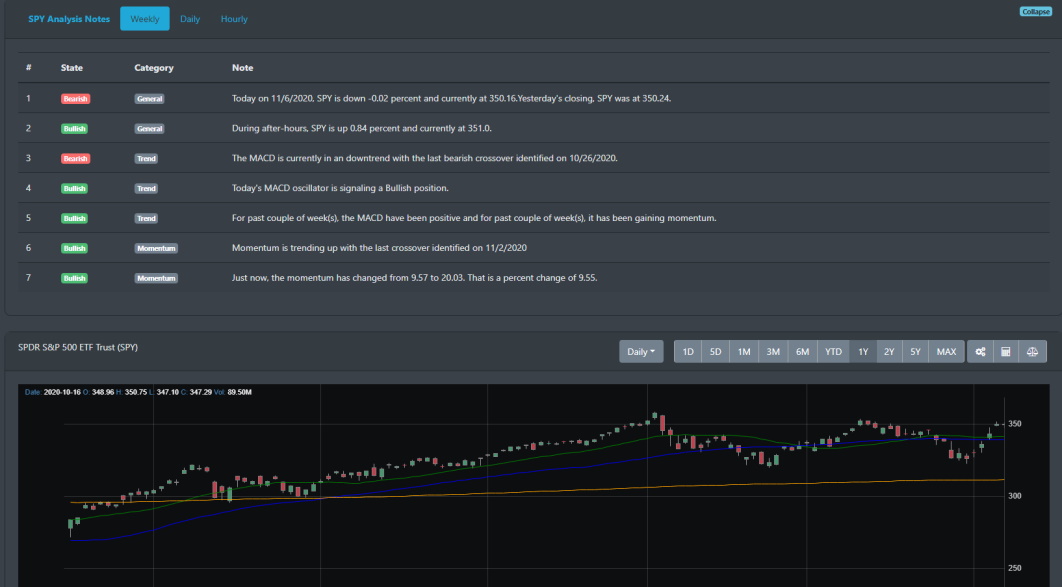

The market rally continues. That is pretty much what the screenshot below tells you. The rally literally pushed the market back above its 50-DMA (blue). It has also blown through BullGap's automatic average trend line(yellow). SPY from Monday to Thursday rose 7.4% while the DIA and QQQ (Nasdaq) made positive gains of +6.5. The only "warning" reading in the screenshot below is the Advance-Decline bearish reading. Over the past few days, it has risen to very high levels which typically indicates extreme overbought conditions. This could signal a short term top in the foreseeable future.

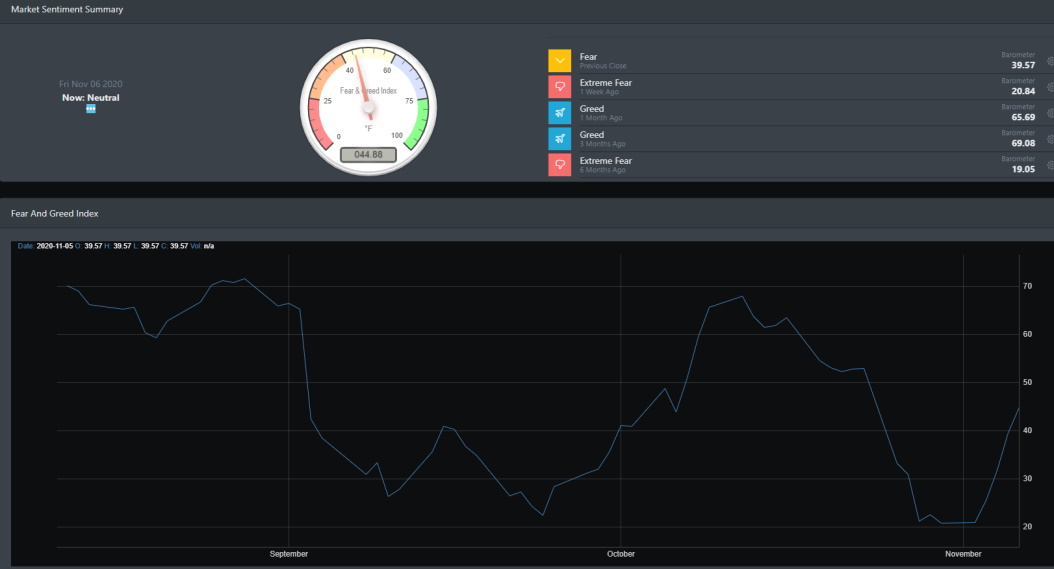

Market Sentiment

Market sentiment moved from Extreme fear (2 weeks ago) to Fear with a reading of 44.88. Starting on Monday 11/2/2020, BullGap's sentiment index was at a low of 20 but rapidly pushed up to 44.88 by the end of Friday's trading session. Market momentum made a large leap this week. So why is the indicator reading fear when the markets are potentially looking at a possible retest of all-time highs? Looking at our detailed sentiment breakdown, it is clear that market breadth remains week with small-cap and value stocks. The CBOE put-call ratio is still bearish and the number of participants hitting all-time highs is still low.

Economy Outlook

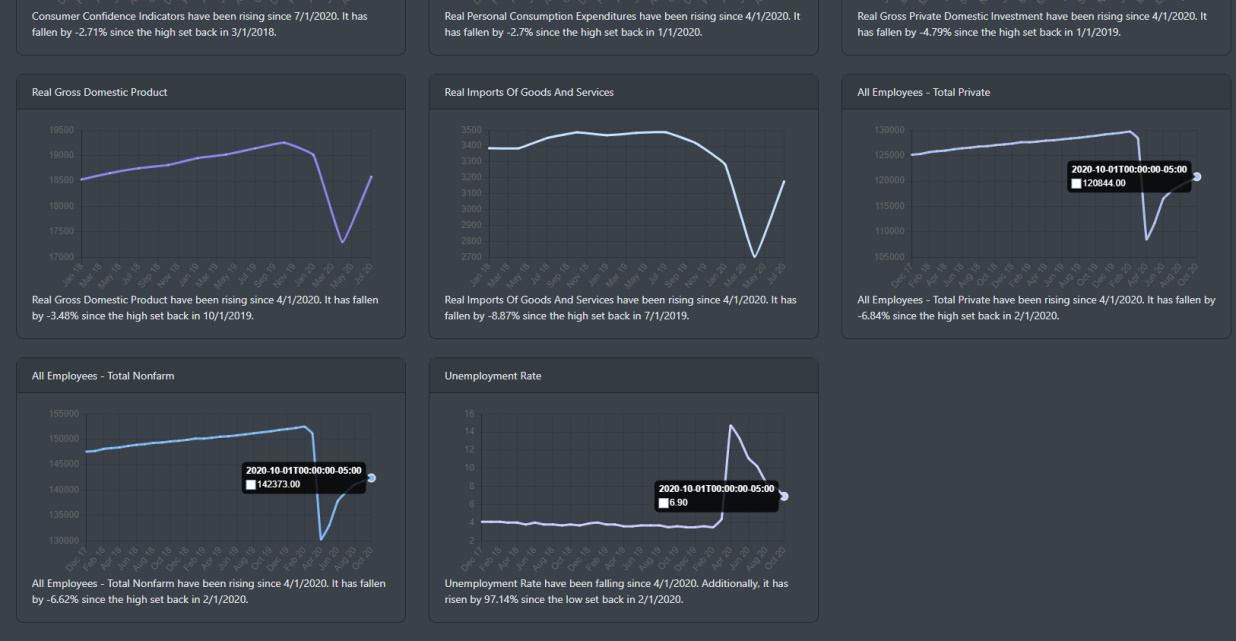

While the market was having a rally, the economy is pushing forward in the right direction. The seasonally adjusted IHS Markit U.S. Services PMI Index posted a reading of 56.9 in October. Up from a 54.6 reading in September, that is a sold up-trend to start the final quarter for 2020. The output was attributed to stronger demand conditions and an uptrend in business activities.

The BLS released the latest employment report last week. Looking at the data below, Total and All Employee readings are still about half of what they were before the pandemic hit in March. The job loss for this year was over 22 million and the economy has gained roughly 12 million back. With high liquidity in the credit market, the financial markets have rebounded. However, the labor market is showing signs of slowing down. With an unemployment rate of 6.9, the labor market has still some work to do before making a V-shape recovery.

Market Outlook

Large-cap was the top performer this week. QQQ (Nasdaq) had over +9% gain while SPY rallied up +7%. IWM also made a good move up. It was interesting to look at the intraday readings throughout the week. The market would gap up higher during pre-trading hours and spend the rest of the normal trading hours consolidating those gains. On Friday, prices started to trend sideways.

QQQ

SPY

Wrapping Up

As discussed above, the market has pushed well above its 50-DMA and is now poised to retest the all-time highs again. Possibly this coming week. This may sound good but there still needs to be some caution to this. As we discussed earlier, some of our indicators show that the market has now swiftly moved back to "overbought" conditions. With all the political unrest and uncertainty with the U.S elections, it was quite good to see the market move forward with the rally. With the volatile months behind us, the market is heading into the next two months where it historically bolds well for the bulls.