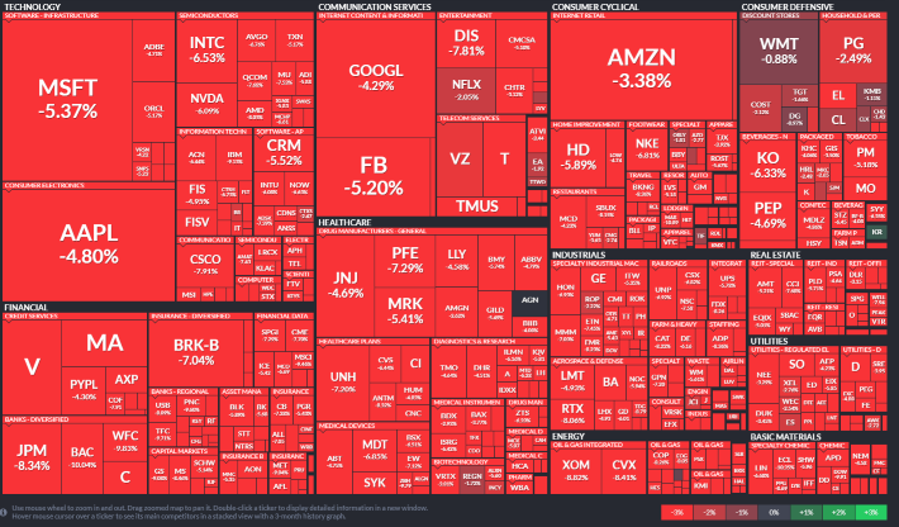

Technically a depression...

Or coming close to it. The steepest contraction in the U.S. economy since the Great Depression has just rung in for Q2 2020 (2Q20 GDP). Not surprisingly, real gross domestic product (GDP) fell at an annual rate of 32.9 percent in the second quarter. In the first q...